In an unpredictable business environment, such as during the COVID-19 pandemic, it can be difficult planning to eliminate, minimise or control risks to your operations. This article offers four types of insurance that can help you deal with uncertainty. Find Out More Here

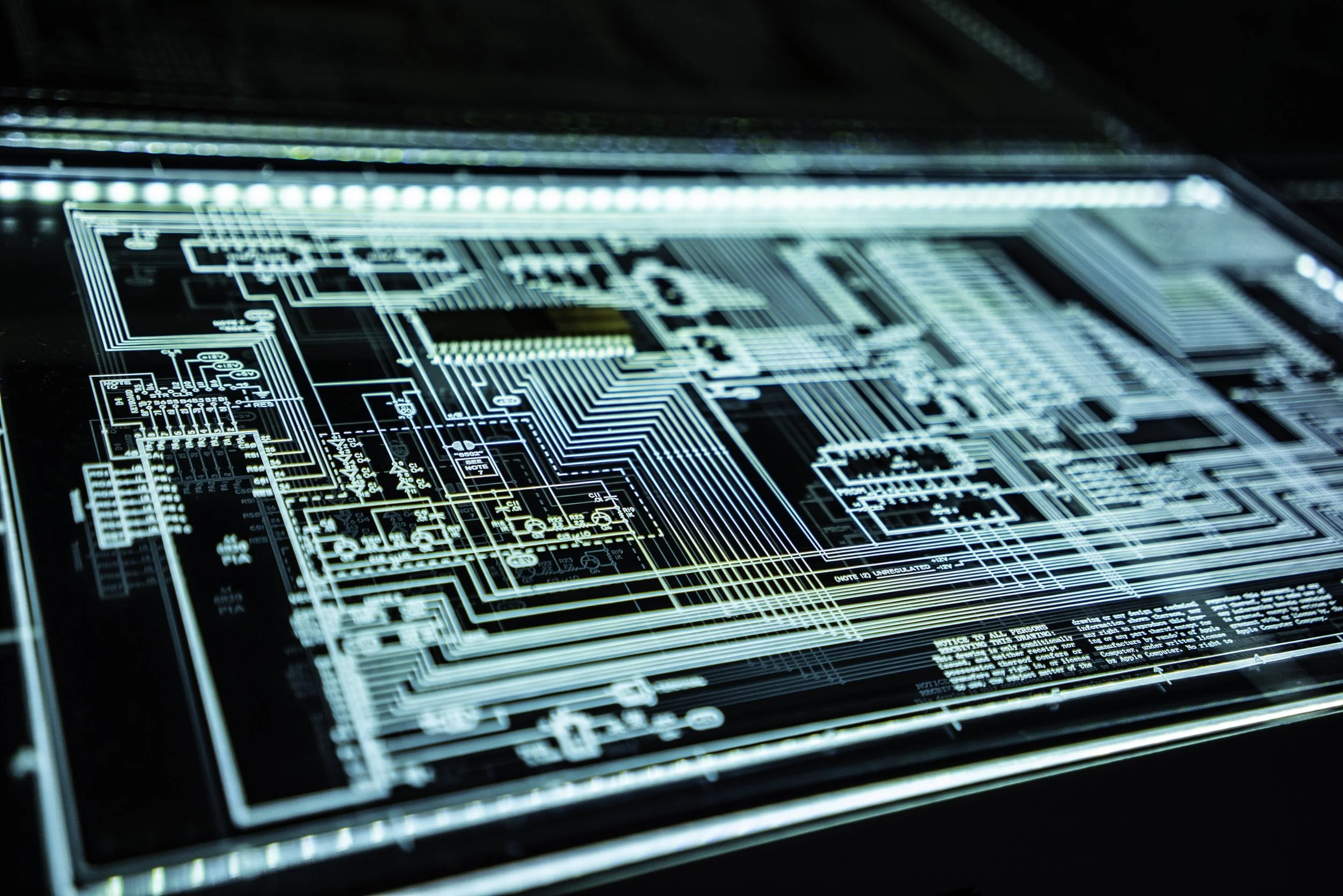

Read MoreWith about 60% of targeted attacks on small-to-medium businesses, cyber security should be a top priority. This year, we expect to see many Australian businesses tackle the following top four cyber threats, as part of best practice data protection. Find Out More Here

Read MoreSome new businesses underinsure, or shirk insurance altogether, but managing your risk profile is a top priority - only 54% of new businesses make it to year 5.

Read MoreHas COVID-19 made you unsure about managing the risks of owning an investment property? This article will update you on what landlord insurance will and won't cover in light of COVID-19.

Read MoreIn business, as in life, things can change unexpectedly, and not always in a positive way. The key to success is to be prepared for almost anything. Easier said than done.

Read MoreHeavy commercial transport helps keep our economy running smoothly, but there's a lot that can go wrong if you're running a transportation business. Do you know who is at the wheel? What happens when there is inadequate journey planning?

Read MoreThe professional indemnity (PI) insurance market has been exceedingly difficult for Financial Planners over the past twelve months. We can expect to see continued high premiums and capacity issues for the foreseeable future, according to David Martin, Director of Professional Lines at AB Phillips Pty Ltd.

Read More“We need to change our thinking, that regulatory reform alone is going to get fairer customer outcomes … the real customer benefit will come from fairness based decision-making and data, to help identify customer needs and design products and services to meet those needs.”

Insurance veteran Paul Muir has some passionate views. What follows are his thoughts on the industry’s key trends and currents.

Read MoreMore goods are being packed and sent across the world than ever before.

Fears that the triumph of the inbox over the letterbox would spell the end of the humble post office turned out to be exaggerated. After all, who could have anticipated the boom in bubble wrap, pack and send? With online shopping, business-to-business (B2B) goods traffic, and changing consumer patterns all in a steep growth trend, Australia Post and other delivery services must be wondering who’s laughing now?

It’s time to think about transit insurance. Read more here>

Read MoreTake a well-earned rest by creating an end-of-year plan for your business. It will bring rewards in the New Year if you treat this as part of your seasonal to-do list, getting things done so that you can enjoy the break.

Read MoreThe liability of principals, contractors and subcontractors is an important issue for Australian businesses providing services or products to the built sector.

The use of subcontractors is common in many industries and it is particularly prevalent in the construction industry. In this sector, a design and construct contract is commonly used, and requires the head contractor to have a single line of responsibility to the principal/developer.

Read MoreProtecting the operational capability and cash flow of your business is one of the most important protections you have — for your business, your investment and the people that depend on it. Here are some of the key areas you might consider when purchasing business insurance.

Read MoreExperiencing a loss can become considerably worse if the insurance you have in place fail to meet your expectations. The failure of an insurance policy can significantly impact your financial position, financial security and ultimately your standard of living.

Read MoreAs the world has become more digitally enabled, so too has the risk of compromise for businesses via digital entry points.

Read MoreThe manufacturing industry, anywhere in the world, is critical to keeping the economy moving. The sector is also one of the most technical, involving a wide range of moving parts including logistical, mechanical and labour resources. It is important that cover is tailored to each business.

Read MoreThe insurance landscape can be complicated and there is a range of industry-specific terms that are used. Here is a guide to the most common ones.

Read MoreIf you have an insurance policy, you’re helping to protect yourself against financial or business loss in the event of an incident. If an event occurs, you’d lodge a claim with your insurer. But how does that process work?

Read MoreProfessional indemnity insurance cover is essential for any professional service provider and reduces risk to claims made against your business.

Read MoreThe internet is a wonderful thing that allows people to shop around to find the best bargain when they’re making just about any sort of purchase. With insurance however, it presents clear risks.

Read More